)

Finding the real value of a business is the first step to selling it or getting a loan. It is not a guess; it is a calculation based on your profits, assets, and market trends. This guide explains the three main ways to value a company: Asset Approach, Market Approach, and Income Approach. We will show you how to use these methods and how PrometAI tools can help you get a precise valuation in minutes.

PrometAI offers a comprehensive solution to this problem. It provides reliable and detailed valuation methods that simplify the process. By using PrometAI, you can ensure your business valuation is accurate and reflective of its true worth. Let's explore how to value a business effectively with PrometAI's expert guidance. For insights into AI Business Valuation, check out our post on How to Use AI in Business Valuation.

What Is a Business Valuation?

Business valuation determines the economic value of a company. It is essential for various financial decisions. Knowing how to value a business helps in selling, attracting investors, or planning mergers and acquisitions.

When selling a business, valuation ensures you get a fair price. Investors need accurate valuations to decide on funding opportunities. Mergers and acquisitions require precise valuations to negotiate terms.

The main components of a business valuation include:

Assets, which are the physical and intangible resources a company owns,

Earnings reflect the company’s profitability over time.

Market position shows how the company stands compared to competitors.

Understanding how to value a business involves analyzing these key components. PrometAI simplifies this process, making it accessible to everyone.

How to Value a Business?

Knowing how to value a business involves several important steps.

Gather financial statements and relevant data.

Choose an appropriate valuation method.

Analyze the results to determine the business's value.

Key factors to consider include:

Financial performance: looks at revenues, profits, and expenses.

Market conditions: assess industry trends and economic factors.

Growth potential: evaluates future opportunities and expansion possibilities.

Common challenges in the valuation process include inaccurate data and subjective assumptions. Market volatility can also impact valuations. Avoid these pitfalls by using reliable data and standard valuation methods.

If you are working on a Real Estate Business Plan, valuation plays a critical role in assessing property investments, determining rental yield potential, and understanding asset appreciation over time. PrometAI helps real estate business owners evaluate market conditions and financial performance using advanced valuation models, ensuring they build a data-driven and investment-ready plan.

Understanding how to value a business helps you make informed decisions. PrometAI provides tools and insights to streamline this process, ensuring accuracy and reliability.

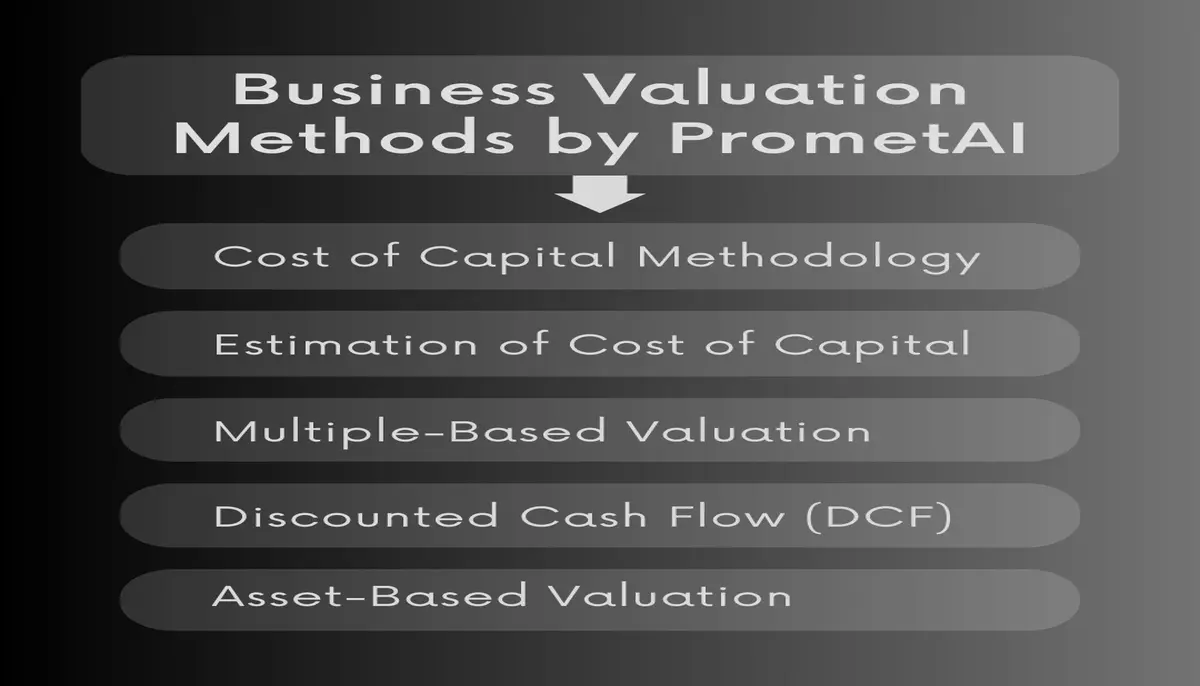

Business Valuation Methods by PrometAI

PrometAI offers several methods to help you understand how to value a business accurately. These methods include Cost of Capital, Estimation of Cost of Capital, Multiple-Based Valuation, Discounted Cash Flow (DCF), and Asset-Based Valuation.

Each method provides a unique approach to business valuation. They consider factors like financial performance, market conditions, and growth potential. PrometAI simplifies these complex methods, making them easy for everyone to use.

For example, if you are working on a Financial Advisor Business Plan Template, accurately valuing your business is crucial. A financial advisory firm would typically use the Discounted Cash Flow (DCF) method to estimate its value based on projected client revenues and recurring fees. Additionally, Multiple-Based Valuation can be applied by comparing revenue or assets to similar firms in the financial advisory sector. Using PrometAI’s valuation tools, advisors can streamline this process and present reliable figures in their business plan.

For example, if you are working on a Financial Advisor Business Plan Template, accurately valuing your business is crucial. A financial advisory firm would typically use the Discounted Cash Flow (DCF) method to estimate its value based on projected client revenues and recurring fees. Additionally, Multiple-Based Valuation can be applied by comparing revenue or assets to similar firms in the financial advisory sector. Using PrometAI’s valuation tools, advisors can streamline this process and present reliable figures in their business plan.

Cost of Capital Methodology

The Cost of Capital methodology helps determine how to value a business by assessing the cost of its financial resources. This method is important for understanding the risks and returns associated with investments in the business.

Steps Involved:

Base Cost of Capital for a Mature Firm: Start by estimating the cost of capital for a mature firm in the same industry. This serves as the baseline rate.

Illiquidity Premium: Add an illiquidity premium to account for the higher risks associated with the startup's size and stage.

Adjustment for Startup Survival Rate: Adjust the combined rate by the historical survival rate of startups to reflect the unique risk profile.

Cost of Capital Methodology Example: TechInnovate Case Study

TechInnovate is a startup in the emerging tech industry. First, we estimate the base cost of capital for mature firms in this sector at 10%. Next, we add a 5% illiquidity premium due to TechInnovate's smaller size and lower market liquidity. Finally, considering the startup survival rate of 50%, we adjust the combined cost of capital (15%) to 7.5%. This adjusted rate reflects the high risk and potential growth of TechInnovate.

Understanding how to value a business using the Cost of Capital methodology helps investors and analysts make informed decisions. PrometAI simplifies this complex process, making it accessible to everyone.

Estimation of Cost of Capital

The estimation of cost of capital is crucial for knowing how to value a business. It represents the return a company needs to achieve to justify the cost of its investments.

Components:

Cost of Equity: Using CAPM, calculate the cost of equity by adding the risk-free rate to the product of the company's beta and the market risk premium.

Cost of Debt: Calculate the cost of debt by determining the interest rate on loans and bonds, adjusted for tax benefits.

WACC: Weighted Average Cost of Capital is calculated by averaging the cost of equity and cost of debt, weighted by their proportions in the capital structure.

Estimation of Cost of Capital Example: EcoFurnishings Case Study

EcoFurnishings plans to raise capital through equity and debt. Using CAPM, they determine the cost of equity is 9.2%. The cost of debt, after-tax adjustments, is 3.5%. With a capital structure of 60% equity and 40% debt, their WACC is 6.92%. This means EcoFurnishings needs to achieve at least a 6.92% return on investments to satisfy investors.

Understanding how to value a business using the estimation of cost of capital helps in making informed financial decisions. PrometAI provides tools to simplify this process for everyone.

Multiple-Based Valuation

Multiple-based valuation is a simple method for knowing how to value a business. It uses financial ratios to compare similar companies.

Common Multiples

P/E Ratio: Compares a company's share price to its earnings per share.

EV/EBITDA: Compares enterprise value to earnings before interest, taxes, depreciation, and amortization.

P/S Ratio: Compares a company's market price to its sales.

Multiple-Based Valuation Example: Comparison Using P/E Ratio

Company A has a P/E ratio of 25, indicating investors pay $25 for every $1 of earnings. Company B's P/E ratio is 20, reflecting slightly lower growth potential. If Company C in the same industry has a P/E ratio of 15, it might be undervalued. This simple comparison helps investors decide if a company is a good investment.

Understanding how to value a business using multiple-based valuation helps investors make quick, informed decisions. PrometAI makes this method easy to apply for everyone.

Discounted Cash Flow (DCF)

The DCF method helps in knowing how to value a business by projecting its future cash flows and discounting them to present value. This reflects the time value of money and investment risks.

Steps Involved:

Estimating Future Cash Flows: Project the company's cash flows over a specific period.

Selecting Discount Rate: Determine the Weighted Average Cost of Capital (WACC).

Calculating Present Value: Discount future cash flows to their present value using the chosen discount rate.

Discounted Cash Flow Example: GreenTech Innovations Case Study

GreenTech Innovations projects cash flows of $1 million to $2 million over five years. With a WACC of 8%, the present value of these cash flows is calculated. This gives a realistic valuation of GreenTech based on its future earning potential.

Understanding how to value a business using the DCF method helps in making sound investment decisions. PrometAI simplifies this complex process, making it accessible to everyone.

Asset-Based Valuation

Asset-based valuation is a straightforward method for knowing how to value a business by calculating its net asset value.

Components:

Tangible Assets: Calculate the current value of physical assets like equipment and inventory.

Intangible Assets: Estimate the value of non-physical assets like patents and trademarks.

Liabilities: Subtract total liabilities from the combined asset value.

Asset-Based Valuation Example: Company X and Company Y Case Study

Company X has $5 million in tangible assets and $2 million in intangible assets. With $3 million in liabilities, its net asset value is $4 million. Company Y has $3 million in intangible assets and $1 million in liabilities, making its net asset value $2 million.

Understanding how to value a business using asset-based valuation helps determine its minimum worth. PrometAI simplifies this process, making it easy for everyone to apply.

Business Valuation Calculator: How PrometAI Enhances the Valuation Process

PrometAI's business valuation calculator simplifies the valuing process with accurate and efficient tools.

Data Analysis and Insights: PrometAI analyzes financial data to identify trends, detect errors, and provide actionable insights. This ensures accurate valuations.

Industry Best Practices: PrometAI applies industry standards to each valuation, ensuring consistency and reliability across different businesses.

User-Friendly Reports: PrometAI generates customizable reports that are easy to understand and share. These reports help stakeholders make informed decisions.

Understanding how to value a business with PrometAI enhances accuracy and efficiency, making the process accessible to everyone. For more innovative approaches, explore our post on Innovative Approaches to Business Valuation in 2024.

FAQs

1. Why do you need to know what your business is worth?

Knowing how to value a business is crucial for selling, attracting investors, securing loans, and strategic planning.

2. How do you judge how much a company is worth?

You judge a company's worth by analyzing financial performance, market conditions, and growth potential using established valuation methods.

3. What is the most common way of valuing a small business?

The most common way of valuing a small business is using the income approach, focusing on earnings and cash flow.

4. What is the rule of thumb for valuing a business?

A common rule of thumb is to value a business at a multiple of its annual earnings, often between two and five times.

5. How to calculate the valuation of a startup company?

Calculate the valuation of a startup by using the cost of capital method, considering industry risks, illiquidity premiums, and survival rates.

Conclusion

Knowing how to value a business is essential for informed financial decisions. PrometAI simplifies this process with various valuation methods like Cost of Capital, Multiple-Based Valuation, DCF, and Asset-Based Valuation. Each method offers unique insights into a business's worth.

PrometAI’s tools analyze financial data, apply industry standards, and generate user-friendly reports. This ensures accurate and reliable valuations.

Try PrometAI for your business valuation needs. It makes understanding how to value a business easier and more precise.